US Banks Pull The Plug On Climate Activism

Yet another sign of collapsing climate activism.

Established in 2021, the Net Zero Banking Alliance (NZBA) is one of the UN's global initiatives to drive climate policy. This alliance of the world's largest financial institutions is working to reduce humanity's CO2 emissions, with the aim of bringing the lending and investment portfolios of its member banks to Net Zero by 2050. In simple terms, the banks that have joined the alliance are not pushing themselves towards zero carbon emissions, but are asking their customers to do so. In practical terms, this has meant, for example, that many projects have become unfeasible for businesses. It is not just a question of planning for fossil fuel production, as the same initiative has also brought under the banks' spotlight sectors such as the highly energy-intensive production of aluminium, iron and steel, agriculture, real estate development, transport, and others, which are vitally important for human life but have higher CO2 emissions.

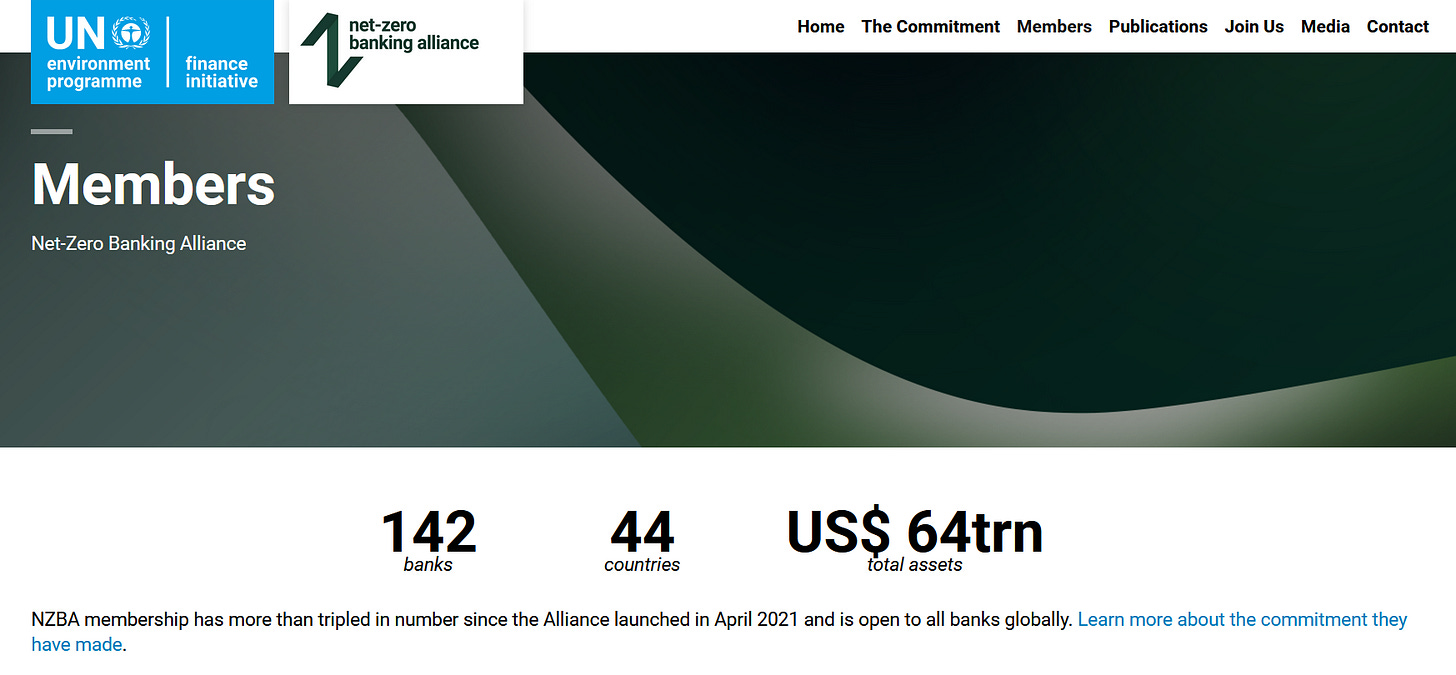

Initially, 43 of the world's largest banking groups joined the NZBA, including, for example, Barclays, Citigroup, Bank of America, HSBC, Santander, Morgan Stanley, Credit Suisse, etc. Since then, the number of banks has grown to 140 in 44 countries with $64 trillion (€57,6 trillion) under management. Now, however, the growth of this initiative has stalled and several major US banks have announced that they are leaving the association altogether, Reuters reports.

Citigroup, Bank of America, and Morgan Stanley were the latest to announce their withdrawal from the NZBA last week. Wells Fargo and Goldman Sachs have also made the same decision.

Citigroup said it had made progress toward its own net zero goals and decided to leave the NZBA. Bank of America said it ‘will continue to work with clients on this issue and meet their needs’. Morgan Stanley, on the other hand, said that while their climate targets remain unchanged, they are now making a different kind of commitment – advising clients on climate and providing capital to build lower carbon businesses.

The real reason why banks are withdrawing their censorious climate policies is not hard to guess. On the one hand, Donald Trump, who is about to take office as US president, has made no secret of his intention to abandon climate initiatives and rely on oil and natural gas for energy policy. On the other hand, the behaviour of the financial sector in refusing to lend to fossil fuel investments has also led to the first major lawsuits in the US. In December, Texas, along with ten other states, sued major investment firms BlackRock and Vanguard, accusing them of violating US antitrust law.

Musk is gonna do it now

🛑Stop Summit Carbon Solutions pipeline. CO2 pipelines are a hoax, money and land grab.